California Laws On Car Title Loans

You just need to get pre-approved go through the approval process and receive your money. Fee transparency is legislated.

Before operating in California lenders have to obtain a California Finance Lender license.

California laws on car title loans. The California Attorney Generals Office and the California Department of Corporations are responsible for enforcing and regulating finance lending laws in the state. You can still keep driving your car throughout the length of the loan as long as your payments are made on time. By exceeding the small loan cap the interest rate cap that California imposes on lenders does not apply.

Car finance loan specifics including the length of the agreement total amount being financed and the payment due dates must also be clearly spelled out for the car buyer due to this federally mandated act. Unlike the pawn system once the car title loan contract is signed in California the car is still used by the customer and the vehicle simply ceases to be owned by the owner at least temporarily. Finance charges on most of these loans are usually very high.

This bill would prohibit a licensee from providing a title loan unless the interest rate on that loan does not exceed 36 per calendar year on the unpaid principal amount of that loan and the licensee provides certain disclosures to the borrower. Auto loan interest rates including any fees or late payment penalty fees must be disclosed to the car buyer in accordance with this law. As a result if your vehicle is worth less than this you will struggle to obtain a title loan.

Anything going under that amount wont be applicable for you to get a car title loan. Borrowers must be informed of all fees by the lender before agreeing to any loans. The vehicles title has been labeled as a Lemon Law Buyback manufacturer repurchase salvage junk non-repairable flood etc.

You dont have to worry about getting around and commuting to work when you take out a car title loan. Illegally included vehicle registration lien and handling fees in bona fide principal loan amounts. The laws in California also state that car title loan lenders must clearly report any and all fees upfront.

Title loans typically are subject to very high interest rates and California law doesnt do. California Laws on Auto Title Loans Title Loan Interest Rates. The DBO moved in December 2018 to revoke TitleMaxs California Financing Law license based on allegations that the lender routinely charged excessive interest rates and fees.

It is worth noting that the legal minimum loan for a title loan in the state is 2500. While for loans that have an amount greater than 5000 there is no maximum loan processing fee. A car cannot be certified if.

To prevent ballooning which is often the cause of repossession California laws require that California car title loans be fully amortized. When getting a car title loan in California you are not selling your car or giving your vehicle away to the lender. The interest rate is capped so most title lenders will not make loans for under 2501 in California.

In this case the ceiling jumps to 75 for loans of up to 4999. Provisions like this help make it possible for the borrower to get affairs in order to renegotiate their loan before the vehicle. This type of pink slip loan lets you borrow over 2510 in California.

And submitted inaccurate reports to the DBO during an examination that. For loans 4999 and under there is a maximum of a 75 loan processing fee. For the most part title loan lenders are unregulated in California because of the legislative loophole in lending laws.

The law allows title loan lenders to charge up to 5 percent of the amount borrowed or 50 whichever is less unless the loan is for more than 2500. Administrative and Processing Fees. The cost of a title loan isnt limited to interest.

Each agency has specific requirements regarding Car Title Loans that lenders have to follow. This means that with every payment you make you are paying for the interest and a portion of the principal. Receiving charges under a title loan agreement in an amount that is greater than 3 per month on the unpaid principal balance of the title loan.

At 855-302-7572 we offer a variety of loans and services. Technically car title loans of up to 2500 are permitted in California and regulated by the state. We offer traditional car title loans that will get you the cash you need to get out of a bind.

Other Title Loan Rules. This means all title loans issued in California should be covered. If payments are strictly complied with both the amount of the loan and the interest the vehicle changes ownership again.

California Department of Corporations. Charged illegal vehicle registration handling fees. The cost of a title loan isnt limited to interest.

After a vehicle has been repossessed under California title loan laws the lender must inform the borrower of their intent to sell the vehicle within 15 days via first-class or certified mail. In California state laws dictate that 2500 is the minimum amount you can borrow. You cannot borrow less than that against your vehicle.

The vehicle has frame damage or was sold to you as-is The odometer was tampered with or does not show the true mileage of the car. Much like a cash advance and payday loans finance charges are high and its important to pay the loan off early. Existing law the California Financing Law CFL provides for the licensure and regulation of finance lenders among others by the Commissioner of Business Oversight.

Lenders can charge administrative or processing fees in California as well.

Auto Title Loans Car Insurance Car Loans Automotive Locksmith

Refinancing Car Title Loans Refinance Car Car Title Best Loans

Ifttt La Mesa Ca Top Auto Car Lender 619 825 2740 Fast Approval Quick Funding Easy Money Https T Co Mrxp2kmelp Car Title Car Loans Car Salesman

5 Car Title Loans For Bad Credit Top Alternatives 2021 Badcredit Org

How To Transfer A Car Title To A Family Member Title Loans California

Car Title Loans Edmonton Lowest Interest Rates Fast Loan Approval Car Title Cash Today How To Get Money

Car Title Loans Consumer Business

Cartitleloans Net Llc Fresno California 1 888 874 9838 Car Title Loans Fresno California Car Buyer Used Car Dealer Car Buying

Car Title Loans 3 Things To Know Before You Get One Credit Karma

Car Title Loans Consumer Business

Car Title Loans Best Auto Title Loan Online Loancenter

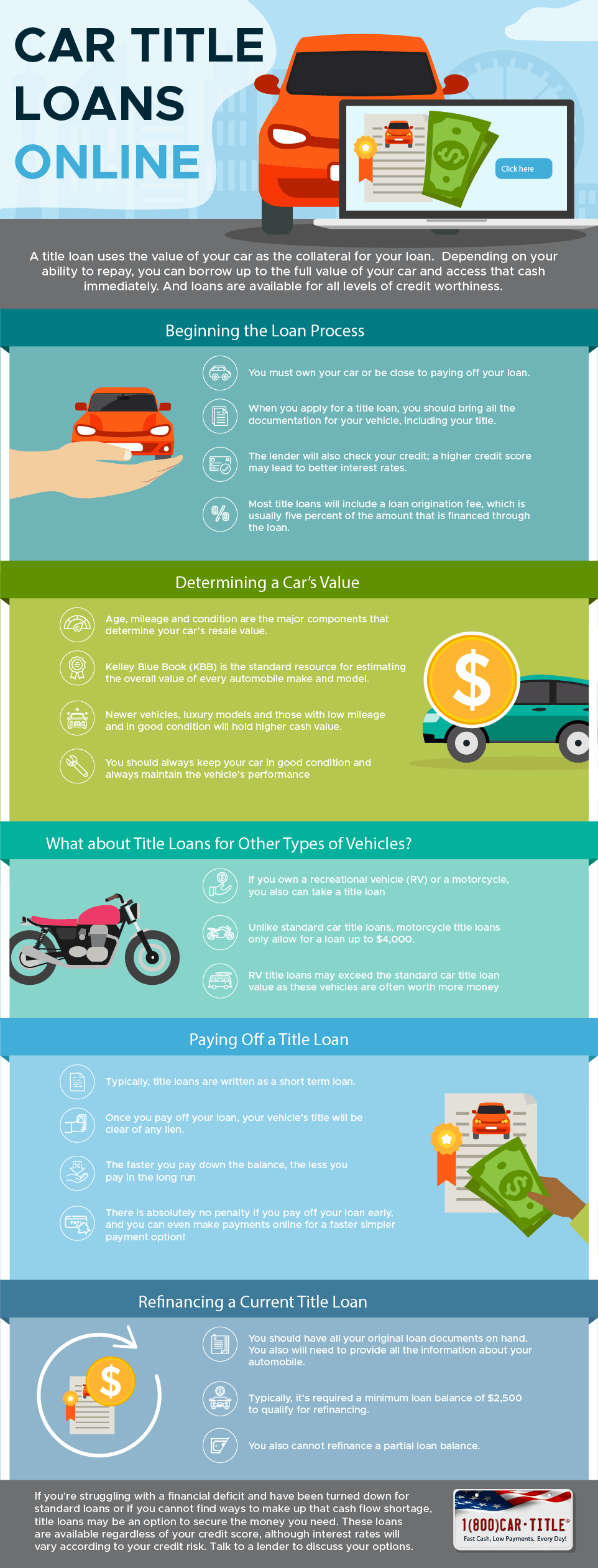

Car Title Loans Online 1 800 Car Title

How To Obtain Your Car Title After Loan Payoff Bankrate

A Fast Same Day Auto Title Loan Up To 80000 Our Expert Loan Agents Are Able T Car Title Loan Car Loans

Car Title Loans Risks And Alternatives Nerdwallet

We Leave No Stones Unturned To Find The Right Lender And Choose The Best Available Car Loan Deal However When Car Finance Car Loans Car Title

Posting Komentar untuk "California Laws On Car Title Loans"